Caption: Geoff Jamieson (Managing Director of ORCODA) and Michael Worthington (Founder of Future Fleet).

Highlights:

• ORCODA wraps up its acquisition of Future Fleet International, which was originally announced in June 2023

• The company handed over two million shares for FFI and will in aggregate pay close to $1.4 million once all conditions are met

• ORCODA expects the acquisition to boost EPS metrics for FY24 over FY23

• The move also gives ORCODA access to more than 6300 vehicles for its software

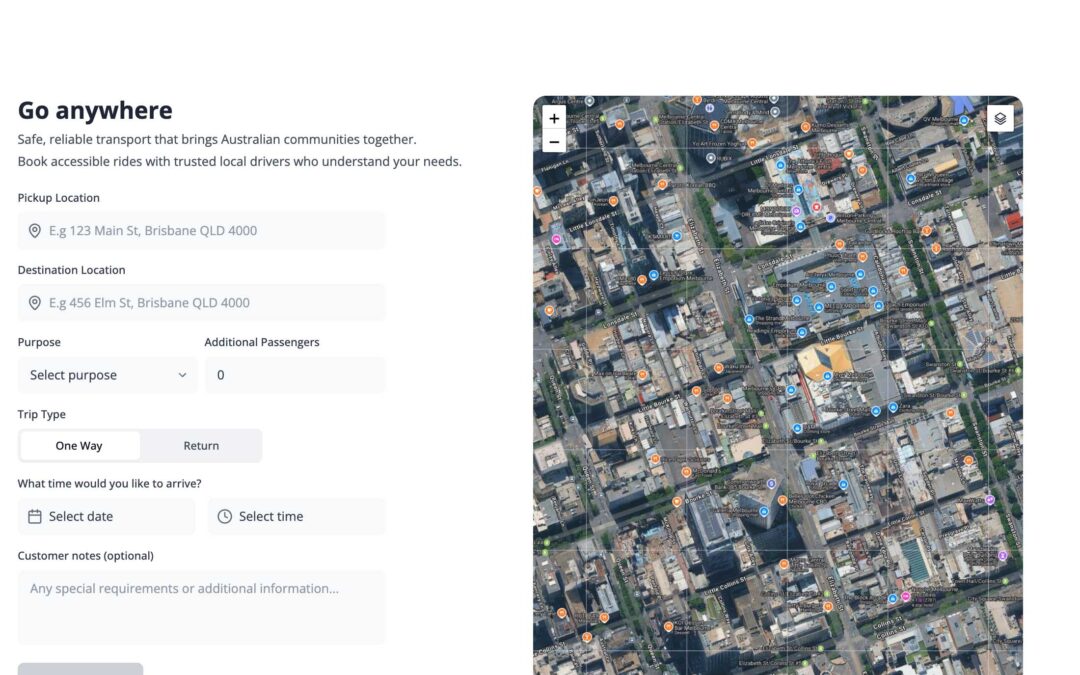

ORCODA recently announced the successful acquisition of Future Fleet, a prominent telematics and asset tracking company. This significant milestone marks a major step forward for ORCODA, expanding its capabilities and market presence in the fleet management industry.

ORCODA Managing Director Geoff Jamieson stated that “The transaction is important to our overall Smart Cities strategy as Future Fleet’s products provide critical vehicle tracking and monitoring solutions and are highly complementary to our transport management and optimisation”.

Future Fleet has been an Australian telematics provider for over 20 years, delivering advanced fleet and asset management solutions including AI driver safety, IOT, satellite tracking, reefer telematics and vehicle tracking.

Through their advanced tracking and monitoring solutions, they have been instrumental in assisting their clients in gaining valuable insights into their fleet operations. Future Fleet’s data-driven approach and expertise have enabled businesses to reduce costs, improve safety, and make informed decisions based on real-time data.

“My key focus is to engage with existing and prospective customers to cross-sell our products, as well as to drive product integration combining Future Fleet’s tracking solutions with ORCODA’s transport optimisation software,” FFI Founder Michael Worthington said.

Caption: The ORCODA and Future Fleet teams on the day of settlement

The acquisition capitalises on the synergies between the two companies – ORCODA’s fleet management platform and Future Fleet’s robust telematics and asset tracking capabilities. Both companies are now positioned as a comprehensive one-stop-shop for businesses seeking advanced fleet solutions.

Financials of the Deal

• ORCODA paid $1.148 million for FFI, comprising $600,000 plus roughly $258,000 of stock at value.

• Additionally, $290,000 will be paid out in two instalments over 12 months after completion, with $145,000 payable after six months if FFI EBITDA is at least $100,000 in that six-month window.

• A second instalment of $145,000 will be payable after twelve months, assuming FFI clocks an EBITDA of $150,000 in the second six months.

• ORCODA offered parties tied to the vendors two million ordinary ODA shares.