What is best practice for shutdown and maintenance projects? To deliver a smooth shutdown and maintenance project without delays or significant budget overruns, minimising downtimes and costs without compromising quality and safety – Plan, Mobilise & Manage.

Plan;

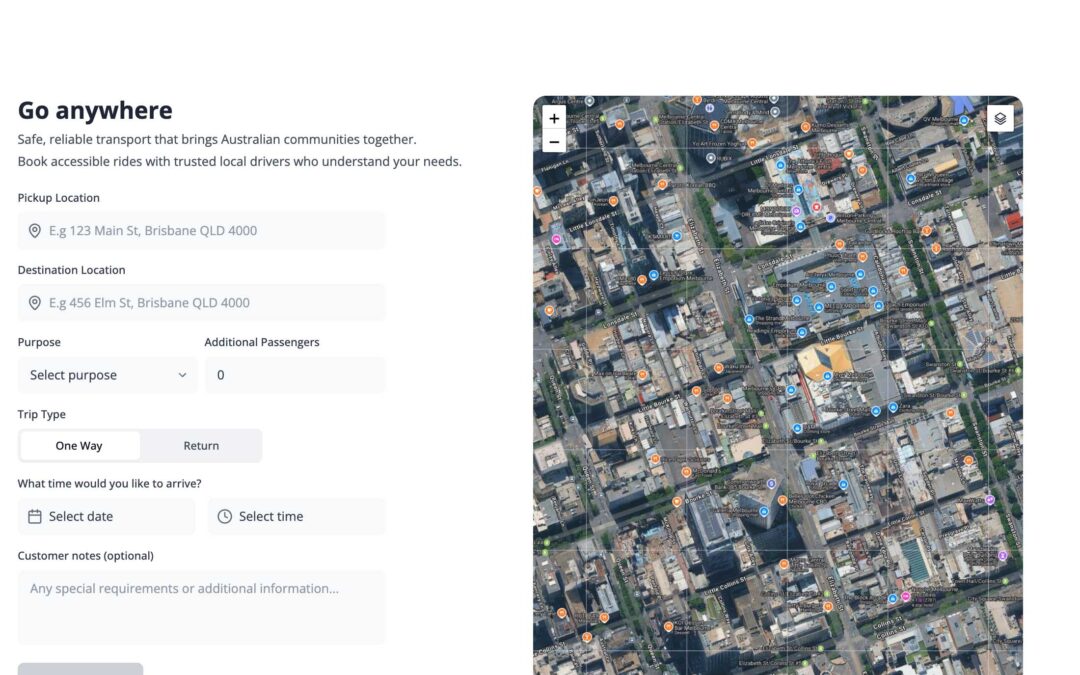

Minset, performance improvement consultants, continually evaluate digital solutions and identified Orcoda’s workforce logistics platform to best offer a scope of sector-suited functions in one suite. Orcoda worked closely with Minset on a customised Transport360 to identify pain points, understand workflows and existing manual systems. Current workforce logistics processes used various disjointed systems creating significant administration workload and room for human error. Orcoda identified the need for centalised, automated workforce development data, efficient mobilisation and critical site access.

Mobilise;

The Transport360 managed workforce selection, rostering, travel, training, and compliance. Staged deployment best supported the wider shut-down plan. The system enabled shutdown contractor groups to take maximum responsibility for their people, providing each company with access to upload worker details in a shared central platform and supported the site team to get personnel from home to site and accommodation in a trouble free and efficient manner. The result ? A positive, ready to work frame of mind and increased worker morale. The client also had real-time visibility of the mobilisation readiness of the contractor workforce.

Manage;

Automated management of 91% of all workforce data by Orcoda, (comprising 24 vendors and 367 workers and assets) meant smoother workflows and real-time reporting with far less potential for error. Team productivity increased with fast tracking identification of training and induction gaps, and vendors provided with daily reports on roles, shift types and start dates. System workforce data collection and reporting functions enabled improved management decisions for future events. The result? Improved safety outcomes and reduced administration activity created the ability to focus on higher value planning and management.

Contact Warren Preston, Director Orcoda Resource Logistics to discuss how to Plan, Mobilise & Manage efficient shutdown and maintenance projects.

Warren Preston:

M: +61 411 594 553

P: 1300 672 632